Robust sales in February brought another healthy sales tax check from the state this month.

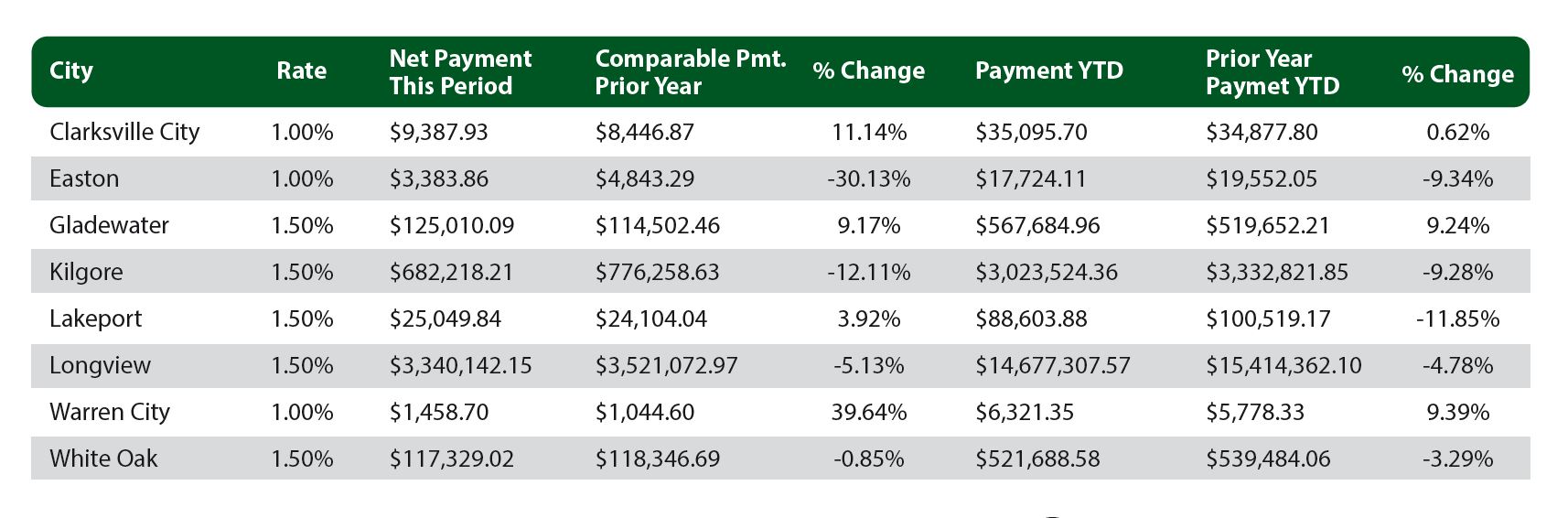

According to the latest numbers from Texas Comptroller Glenn Hegar’s office, the City of Gladewater’s allocation for April is 9.17 percent more than the same month last year, $125,019.09 compared to $114,502.46 in April ‘23.

That puts the community at 29 consecutive months of year-to-year gains – and then some – according to interim City Manager Charlie Smith.

For the year-to-date, City Hall’s coffers are heavier by 9.24 percent compared to the same time in 2023.

The exact cause of the recent, and ongoing, increase in returns is a bit nebulous. There are a myriad of factors at play, Smith confirmed, from out-of-town visitor dollars to new business ventures and active retail outlets.

“It’s not 100 percent inflation,” he said. “To me, I’m seeing more and more people downtown.”

Smith credits the ongoing revitalization and resurgence of Gladewater’s shopping district with drawing more out-of-town visitors in addition to locals. Likewise, he said, destination restaurants like Skipper’s Pier and new offerings like Manni’s Italian Kitchen are boosting the local economy as well.

“I think the restaurants are going to be a big part of it.”

In addition to tourists and residents, Gladewater seems to be benefiting from an increasing amount of commerce from travelers’ pit-stops and, also, from activity at local dollar stores.

“There’s just a lot of traffic that passes through here,” Smith said, noting healthy activity at well-placed convenience stores. Similarly, roughly half-a-dozen small retailers are undoubtedly contributing to overall customer traffic, too, with combined sales to rival a ‘Big Box’ retailer: “There’s sales tax right there.”

Smith also sees healthy progress in the number of constant free-to-the-public activities that draw outside dollars into the community.

“We have some kind of event every month,” he added, such as Gusher Days this weekend. “That drags people in from all over. There’s no telling how many folks from out of town are going to be here just for that, and the tax dollars spent. Then, the rodeo’s coming to town.

“I think Gladewater just has a lot to offer, and we’re benefiting from that as a city.”

Notably, sales tax allocations from the state are based on activity two months prior – returns won’t show an impact from Gusher Days, for example, until June.

“We’ll see what that does.”

Statewide, Hegar’s office distributed approximately $1.03 billion in monthly sales tax revenue to cities, counties, transit systems and special purpose districts statewide. Across Texas, April’s sales tax allocations (from February sales by monthly-filing businesses) exceeded the prior year by 5.5 percent.

– By James Draper